Resilience Financing Options in Connecticut – CIRCA Releases Fact Sheet

By Rebecca French,1 Wayne Cobleigh,2 Jessica LeClair,1 and Yi Shi3

1 Connecticut Institute for Resilience and Climate Adaptation

2 GZA GeoEnvironmental, Inc.

3 Yale School of Forestry & Environmental Studies

Becoming resilient to the impacts of climate change and extreme weather in Connecticut has a price. To date, in Connecticut most of the dollars invested in resilient infrastructure have come from federal grants provided in the form of assistance after a declared disaster, but grants alone will not cover the bill. The fact sheet released today entitled, Financing Resilience in Connecticut: Current Programs, National Models, and New Opportunities, reviews existing resilience financing programs in Connecticut as well as model programs that can be applied in the State.

The fact sheet accompanies a presentation at the Friday April 22 Earth Day 2016 symposium, Resilience and the Big Picture: Governing and Financing Innovations for Long Island Sound and Beyond, sponsored by the Connecticut Sea Grant, the National Sea Grant Law Center, and the UConn School of Law Center for Energy & Environmental Law. The symposium is free and open to the public. The presentation will review the programs listed below in more depth, while also taking a look at the challenges facing the implementation of these programs in the State.

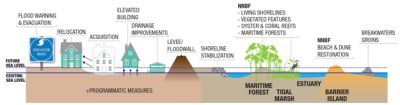

The presentation and fact sheet aim to educate Connecticut’s municipalities, regulators, policymakers, and legislators on the need to collaborate on developing financing methods for resiliency, including innovative public-private partnership models, and adaption of existing public and private finance models for resiliency. These actions will proactively address flood insurance affordability and promote voluntary climate adaptation measures (Figure 1) to reduce and avoid future losses (to life, property/casualty, property tax, critical infrastructure and business continuity). Most importantly, Connecticut needs these financing methods in place prior to the next natural disaster when motivation to rebuild resiliently is high. Developing effective financing methods for resiliency now will benefit vulnerable residents, natural ecosystems, businesses, and government (local, state, and federal). Investments in the short-term will create taxpayer savings for disaster recovery costs and lead to more affordable flood insurance over the long-term.

We are not providing an endorsement of any one approach to financing resilience and there may be other opportunities that could be considered that are not reviewed here. Resilience financing is an emerging area of policy research and new ideas are put forward every day. We hope that this presentation will serve as a starting point for a growing list of finance options for Connecticut and that we can leverage our local talent in insurance, finance, science, and engineering to create a national and global model for innovative and sustainable resilience financing.

Figure 1. Sea level rise and flooding adaptation measures needing federal, state or local funding or long-term financing to be implemented in coastal communities in Long Island Sound. NNBF stands for natural and nature-based features. (Credit: USACE North Atlantic Coast Comprehensive Study.)

Connecticut Resilience Financing Programs

Shore Up Connecticut. Shore Up Connecticut is a low interest loan program, run by the Housing Development Fund, for homeowners and small businesses in the coastal floodplain to elevate structures and utilities.

Microgrids Grants and Green Bank Financing Program. The Department of Energy and Environmental Protection administers the microgrids grants program. These grants provide funding for energy sources that can operate without the grid. The grants can be paired with financing from the Connecticut Green Bank for additional infrastructure to install the microgrid.

Clean Water Revolving Loan Funds. Loans from the Clean Water Fund provide a low interest loan and grant combination to fund wastewater infrastructure projects. Connecticut’s program has provided funding for planning and designing new facilities to operate safely and resiliently under conditions of more frequent and intense storms, flooding, and sea level rise.

Tax Increment Financing (TIF) Districts. TIF districts use increased market value of property and capital improvements that come from public-private partnership investments to a specific geographic area to fund that investment. A TIF district captures the future net economic value increase from the investment through district-level taxes or fees. TIF districts could, in principle, finance neighborhood-scale resilience projects.

Model Programs for Resilience Financing

Connecticut Green Bank C-PACE and R-PACE Programs and PAR. The Connecticut Commercial Property Assessed Clean Energy (C-PACE) program allows businesses to pay for energy efficiency projects through capital assessed on their tax bill and carried over as a lien on the property, regardless of a change in ownership. This same principle can be applied to residential properties or a Residential-PACE (R-PACE). Using the same principles as C-PACE and R-PACE, Property Assessed Resilience (PAR), captures the increased property value and insurance savings to finance resilience measures for a property.

New Jersey Energy Resilience Bank (ERB). The ERB intends to fund distributed energy resource technologies that can operate in island mode with power blackout start capabilities, both of which allow for operation of critical facilities during extended power outages to the grid. The program is a mix of grants and low interest loans and was capitalized with federal disaster recovery funds from Sandy, utilizing a unique waiver of small business only rules.

Energy Savings Performance Contracts (ESPCs). Owners of properties with large energy usage can hire an Energy Services Company (ESCO) and an Owner’s Representative to assist the owner in procuring financing, installation, operation, and maintenance of building retrofits involving onsite energy generation, energy efficiency, and water conservation related capital improvements. The ESCO can access long-term financing methods such as Tax-Exempt Lease Purchase (TELP) commercial loan or bonds for these projects with limited or no up-front costs to the owner. Cash flow to the ESCO from the energy savings pays down the financing over the term of the TELP.

Resilience Bonds. Resilience bonds modify the existing catastrophe bond insurance market to capture the savings from a lowered risk of insurance payouts and then use that value as rebates to invest in resilient infrastructure projects.

References

CIRCA Financing Resilience Fact Sheet

French, Rebecca; Cobleigh, Wayne; LeClair, Jessica; Shi, Yi. “Financing Resilience in Connecticut: Current Programs, National Models, and New Opportunities.” Fact sheet. Connecticut Institute for Resilience and Climate Adaptation. University of Connecticut, Groton, CT. April 19, 2016.

Shore Up Connecticut (Former)

Shore Up Connecticut, Project Information Form, Shore Up Connecticut: Connecticut’s Shoreline Resiliency Loan Fund, Housing Development Fund (2014)

Microgrids Grants and Green Bank Financing Program

Microgrid Grant and Loan Program, Connecticut Department of Energy and Environmental Protection, (last updated December 2014), available at http://www.ct.gov/deep/cwp/view.asp?a=4120&Q=508780.

Connecticut Microgrid Program – Project Financing, Energize Connecticut (2015), available at http://www.energizect.com/your-town/solutions-list/microgrid_financing.

Clean Water Revolving Loan Funds

The Clean Water Fund: Financial Assistance for Municipal Projects, Connecticut Department of Energy and Environmental Protection (last updated March 15, 2016), available at http://www.ct.gov/deep/cwp/view.asp?a=2719&q=325576.

Tax Increment Financing (TIF) Districts

Richard Brugmann, Financing the Resilient City: A demand driven approach to development, disaster risk reduction and climate adaptation – An ICLEI White Paper, ICLEI Global Report (2011), available at https://www.environmental-finance.com/assets/files/Report-Financing_Resilient_City-Final.pdf

Connecticut Green Bank C-PACE and R-PACE Programs

C-PACE, Sparked by Connecticut Green Bank, Connecticut Green Bank (last accessed April 15, 2016), available at http://www.cpace.com/.

Clean Energy States Alliance, Residential Property Assessed Clean Energy – A Connecticut Program Viability Assessment, Report for the Connecticut Green Bank 55-58 (January 30, 2015) available at http://www.cesa.org/assets/Uploads/R-PACE-CT-Viability-Assessment.pdf.

Property Assessed Resilience (PAR)

Howard Kunreuther and Erwann Michel-Kerjan, People Get Ready: Disaster Preparedness, 28 Issues in Science and Technology (2011), https://issues.org/kunreuther/

Wayne Cobleigh,CPSM, GZA GeoEnvironmental, Inc., Howard Kunreuther, Risk Management and Decision Process Center, The Wharton School, University of Pennsylvania; Rebecca French, Ph.D., Connecticut Institute for Climate Resilience and Adaptation (CIRCA), University of Connecticut Connecticut’s Model for Property Assessed Financing for Affordable Flood Resilience

New Jersey Energy Resilience Bank

Energy Resilience Bank, State of New Jersey Board of Public Utilities (last accessed April 15, 2016), available at http://www.state.nj.us/bpu/commercial/erb/.

Energy Savings Performance Contracts

Chris Lotspeich, Stamford, Connecticut: a City on the Cutting-Edge of Sustainable Development, NESEA blog (January 4, 2016) available at http://nesea.org/conversation/masters-blog/stamford-connecticut-city-cutting-edge-sustainable-development.

Resilience Bonds

Shalini Vajjhala, Financing infrastructure through resilience bonds, (December 16, 2015), available at http://www.brookings.edu/blogs/the-avenue/posts/2015/12/16-financing-infrastructure-through-resilience-bonds-vajjhala.

Shalini Vajjhala and James Rhodes, re:focus partners, llc., Leveraging Catastrophe Bonds – As a Mechanism for Resilient Infrastructure Project Finance, RE.bound Report (December 9, 2015), available at http://www.refocuspartners.com/reports/RE.bound-Program-Report-December-2015.pdf.

About the Authors:

Rebecca A. French, Ph.D. is a Program Director with the University of Connecticut, Connecticut Institute for Resilience and Climate Adaptation and was an AGU Congressional Science Fellow with the U.S. Senate and a AAAS Science & Technology Policy Fellow with the U.S. Environmental Protection Agency Office of Research and Development Innovation Team.

Wayne W. Cobleigh, CPSM is a Vice President – Client Services with GZA GeoEnvironmental, Inc. in Norwood, Massachusetts and is a current member of the Board of Directors of the Connecticut Green Building Council.

Jessica H. LeClair is the Program Manager with the University of Connecticut, Connecticut Institute for Resilience and Climate Adaptation and was an Environmental Analyst at the State of Connecticut Department of Energy and Environmental Protection’s Office of Climate Change.

Yi Shi is a graduate student in the Yale School of Forestry and Environmental Studies and currently serves as the Editor-In-Chief for the Yale Environment Review and was a Sustainability Fellow with the International Alliance of Research Universities.

Acknowledgments:

The fact sheet was released as part of a presentation at the Earth Day 2016 symposium Resilience and the Big Picture: Governing and Financing Innovations for Long Island Sound and Beyond, sponsored by the Connecticut Sea Grant, the Sea Grant Law and Policy Center, and the UConn School of Law Center for Energy and Environmental Law by Rebecca French and Wayne Cobleigh, entitled, “Financing Resilience in Connecticut: Current Programs, National Models, and New Opportunities.” The forthcoming publication in the Sea Grant Law & Policy Journal of the same title is co-authored by Rebecca French, Wayne Cobleigh, Jessica LeClair, and Yi Shi. With the creation of CIRCA, addressing needs for insurance, finance, and policy were listed as priority research areas for the Institute. This presentation, fact sheet, and forthcoming publication are the first research products in that area and were supported in part by the grant from the Department of Energy and Environmental Protection that created CIRCA.

Suggested Citation for Fact Sheet:

French, Rebecca; Cobleigh, Wayne; LeClair, Jessica; Shi, Yi. “Financing Resilience in Connecticut: Current Programs, National Models, and New Opportunities.” Fact sheet. Connecticut Institute for Resilience and Climate Adaptation. University of Connecticut, Groton, CT. April 19, 2016.